gambling income tax calculator

To calculate the presumptive guideline amount. Professional Gambler Tax Calculator - Estimate the tax impact of filing as a Professional or Recreational Gambler.

2022 2023 Tax Brackets Rates For Each Income Level

Subtract 20 of the income of the lower income spouse.

. According to Mississippi tax law and the Mississippi Lottery Corporation the state regulator prize winnings reported above 600 are subject to the standard state tax of. Taxable Gambling Income. Gambling Income Tax Calculator.

The effective tax rate is the amount paid annually as a percentage of home value. This page contains a calculator for computing the income tax liability on gambling winnings. 31 2019 taxes on gambling income in Illinois are owed regardless of what.

Medford is located within. Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. The marginal tax rate is the bracket where.

As for state taxes in Ohio you report gambling. For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction. You can get an indication of how much you will have to pay in Kansas gambling taxes by filling in your details on our tax calculator.

This type of gambling establishments host casino games with a race track. Other Resources - Other information related to gambling taxes. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. An average effective tax rate presents an indication of the overall level of taxes in an area but its not used. Players should report winnings that are.

How do you get. The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot. Marginal tax rate is your income tax bracket.

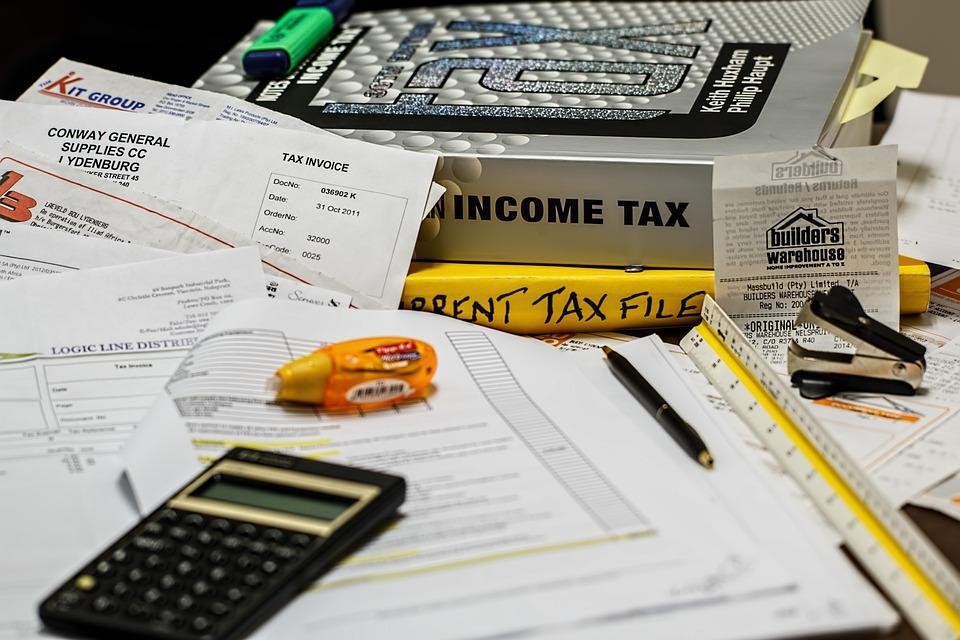

It takes into account gambling losses non-gambling income the amount of itemizable. The following rules apply to casual gamblers who arent in the trade or business of gambling. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT.

Its determined that gambling losses are a miscellaneous deduction. Discover the best slot machine games types jackpots FREE games. You will pay gambling tax as you file income taxes.

Not always the betting exceeds slot machines but the US is opening to new ideas and in many locations you. The average cumulative sales tax rate in Medford New York is 863. 419 Gambling Income and Losses.

On your federal form you submit this as other income on Form 1040 Schedule 1. Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495. Take 30 of the income of the higher income spouse.

The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. This includes the rates on the state county city and special levels. Gambling winnings are fully.

This will itemize your gambling income. Play for free Closed Captioning Contact.

Gambling Tax In Canada 2022 Guide To Casino Taxes

Informative Guide On How Lottery Winnings Are Taxed Ageras

Federal Income Tax Calculator How To Estimate Your Taxes

Tax Calculator Estimate Your Taxes And Refund For Free

Gambling Taxes How Does It Work And How Much Does It Cost

Income Tax Calculation Using New Income Tax Calculator Excel Formula 2022 Youtube

Free Gambling Winnings Tax Calculator All 50 Us States

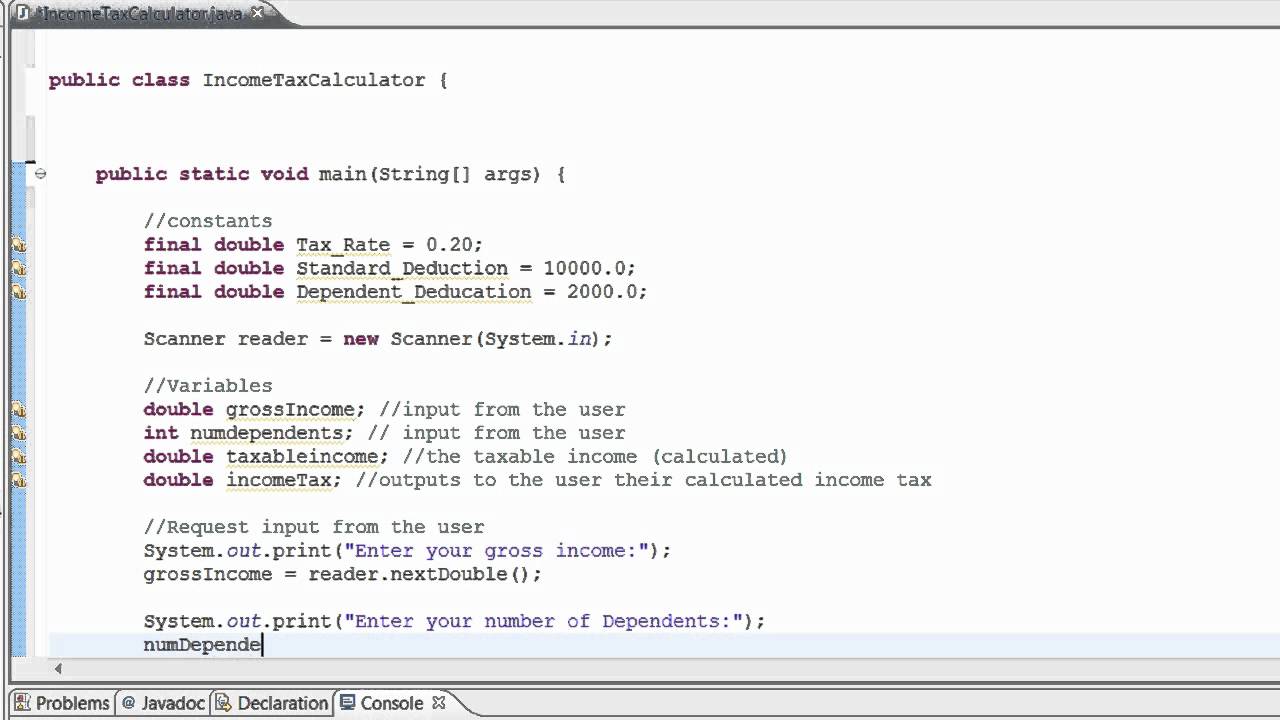

9th Java Tutorial Part2 Income Tax Calculator Youtube

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

If You Make A Bundle Gambling On Line Do You Have To Pay Taxes On What You Win Burlington Gazette Local News Politics Community

Income Tax Calculator 2021 2022 Estimate Return Refund

Simple Tax Refund Calculator Or Determine If You Ll Owe

Video How To Calculate Income Tax In Fy 2021 22 On Salary Examples New Slab Rates Rebate Fincalc Blog

Income Tax Calculation Using New Income Tax Calculator Excel Formula 2022 Youtube

Free Gambling Winnings Tax Calculator All 50 Us States

If You Make A Bundle Gambling On Line Do You Have To Pay Taxes On What You Win Burlington Gazette Local News Politics Community

Irs Refunds Taxes On Casino Winnings Tax Refund Calculator

New York Takes A Gamble With 51 Tax On Online Sports Betting